CONSULTING

INTELLIGENXE helps companies across various industries discover and maximize their productivity and growth potential through the use of artificial intelligence (AI). We provide advisory services through a wide range of consulting engagements — from short-term hourly or verbal consultations to long-term product development cycles.

Our consulting work is based on the following three pillars:

| – Artificial intelligence (AI) expertise – Corporate and business strategy expertise – Innovation experience and track record |

Team

Our team is a network of subject matter experts, each specializing in one or more of our three pillars. Our founder, David R. Rivas, Ph.D., exemplifies this unique combination:

Artificial intelligence (AI) expertise: At MIT, David earned two master’s degrees and a Ph.D. in AI — before the field was commonly known as AI. Over the past several years, he has served as Director of AI at a global AI-based technology company, where he built the AI department from the ground up into a skilled team that has developed numerous AI applications.

Corporate and business strategy expertise: After completing his Ph.D., David worked for a decade as an equity research analyst at various Wall Street firms in New York City, where he analyzed the corporate and business strategies of over a hundred publicly traded companies across multiple industries.

Innovation experience and track record: David is the inventor of the four innovations described on this website (see the secondary menu), all designed to disrupt and enhance the productivity and growth potential of Wall Street firms. These innovations are open source — disclosed on this website and freely available to all institutions.

Get Started (Quickstart)

INTELLIGENXE invites companies—large or small, private or publicly traded—to schedule a free 15–30 minute discovery call. The call will help assess the potential of AI in your business and outline options for how INTELLIGENXE can support your company in realizing that potential.

If you are a decision-maker at your company, please book a free call with INTELLIGENXE (include your company’s website address in the Calendly notes by using this link).

ACADEMIC

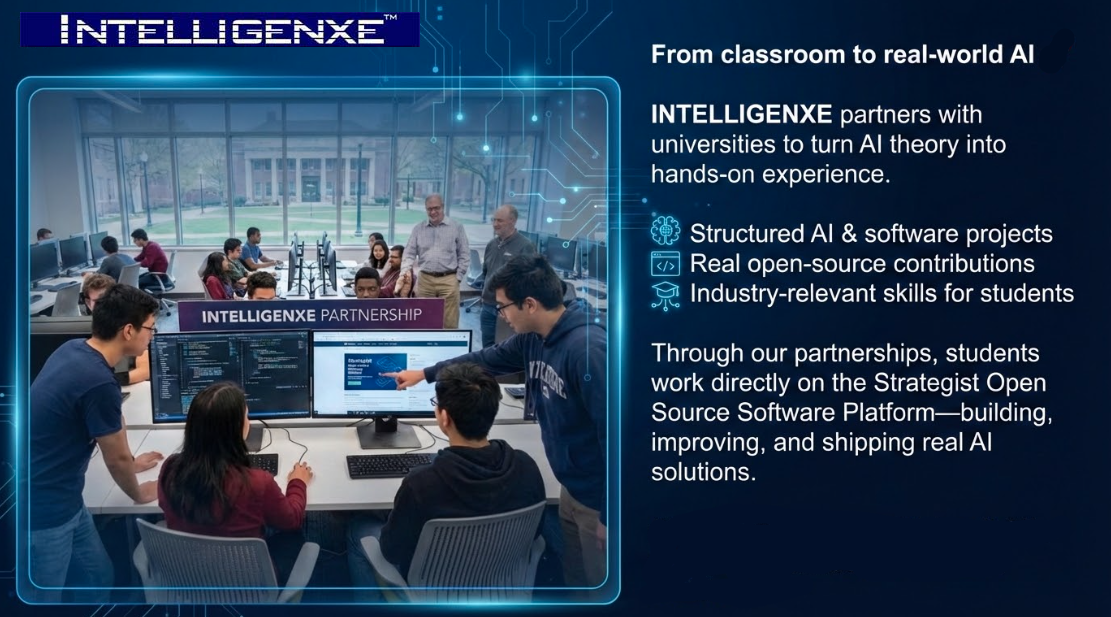

For Universities (and organizations seeking to train their personnel/students in AI/GenAI):

INTELLIGENXE establishes formal alliances and partnerships with universities in the U.S. and Canada to complement their theoretical and practical course offerings—including special project courses and thesis work—with real-world, hands-on experience in AI and software development. INTELLIGENXE provides structured projects and programs specifically designed to allow students to gain practical experience by developing and enhancing components of the Strategist Open Source Software platform.

Get Started (Quickstart)

If you are a professor interested in incorporating real-world practical experience into your course content efficiently, please book a free call with INTELLIGENXE (include your department and university names in the Calendly notes by using this link).