David Rivas, Ph.D. conceived his first two inventions, OFIP and OPTIMAL FUND, around the year 2000 while working on Wall Street. Since then, these disruptive innovations—born from the advent of the Internet—have been continuously refined with new ideas, often inspired by advancements at the frontiers of artificial intelligence (AI).

Although these two inventions are independent of each other, both leverage the transformative power of the Internet’s super-connectivity and AI’s super-intelligence. Together, they mark the beginning of a movement—a school of thought—centered on using collaborative production to maximize productivity and growth, not only on Wall Street but across all industries.

More recently, David has designed two additional innovations: AI-TRADER and the WALL STREET PROTOCOL (WSP). AI-TRADER explores novel applications of AI reinforcement learning, while WSP enables organizations to interact with AI through a decentralized AI-blockchain ecosystem.

Due to their immense potential to benefit society, all four of these innovations are open source—fully disclosed on this website and freely available to all institutions.

For more information about Intelligenxe, please contact us at info@intelligenxe.com.

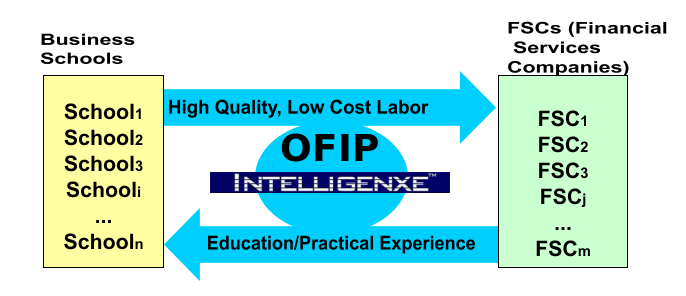

OFIP

OFIP is a business model for Wall Street and the Private Equity and Venture Capital industries. OFIP enables these financial services companies (FSCs) to have the potential to perform most of their financial/investing work significantly more efficiently than their traditional peers, including:

– Higher Margins

– Higher Returns/Growth

– Morality/Transparency/Accountability

– Chinese-Wall

– Minimized Cyclicality and Risk

– AI Safety

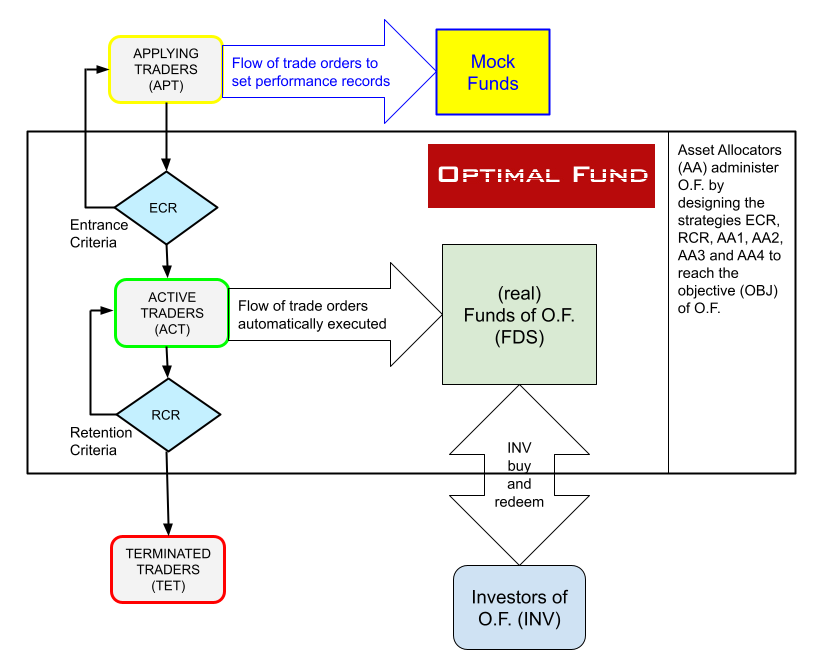

OPTIMAL FUND

OPTIMAL FUND is a business model for asset management that leverages artificial intelligence (AI) by using the survival of the fittest principle.

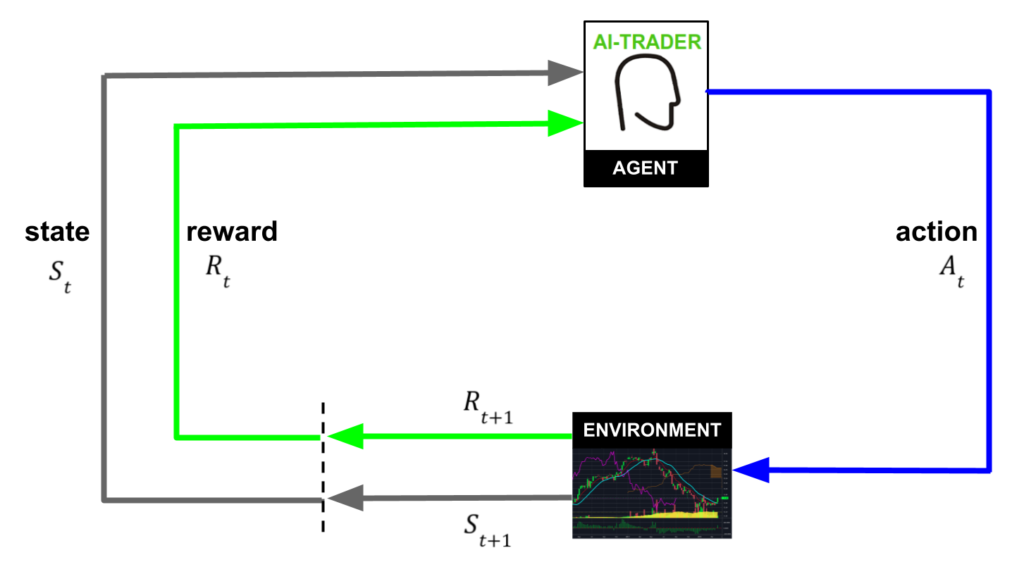

AI-TRADER

AI-TRADER is a deep-reinforcement-learning AI (Artificial Intelligence) model that learns how to trade funds, almost like humans do. However, because of greater computational power and the use of more data AI-TRADER is able to surpass the learning and trading skills of humans and thus outperform human traders and markets.

WSP (Wall Street Protocol)

– In investing and trading, accurate information is crucial for success. However, Generative AI can now create highly realistic fake content, increasing the risks of misinformation and reality distortion, which can lead to poor investment decisions and capital losses.

– A Web3 decentralized AI framework could mitigate these risks by ensuring traceability, transparency, and data integrity, enabling Wall Street firms to rely on verifiable information. This could give Web3-powered Wall Street firms a competitive advantage, allowing them to outperform centralized counterparts while enhancing AI safety.

– Intelligenxe’s WSP (Wall Street Protocol)’ s objective is to provide Wall Street firms with such a solution.